Why portfolio management maturity improvement is hard

Why portfolio management maturity improvement is hard

We work with organizations that want to improve their portfolio management process. It strikes me that these improvement efforts take a significant amount of time and effort to complete, or even sometimes do not make progress. can we diagnose this issue with stating that this is a tough change process (as is any improvement)? I find that digging a little deeper usually gives us two different underlying causes for this slow progress of improvements.

One root cause has to do with the inherent nature of portfolio management: it is a key decision process to link strategy to execution. In order to implement improvements, all key stakeholders have to be aligned on the need and the value of improving this process. Since this always involves more transparency on strategy and projects, this may be threatening. So a culture of rewarding (the right) transparency and accountability is needed.

But there is a second complication, which is more specific for portfolio management: the low frequency of running a portfolio review in low maturity organizations (once a year maybe). This is the vicious circle of portfolio management improvement.

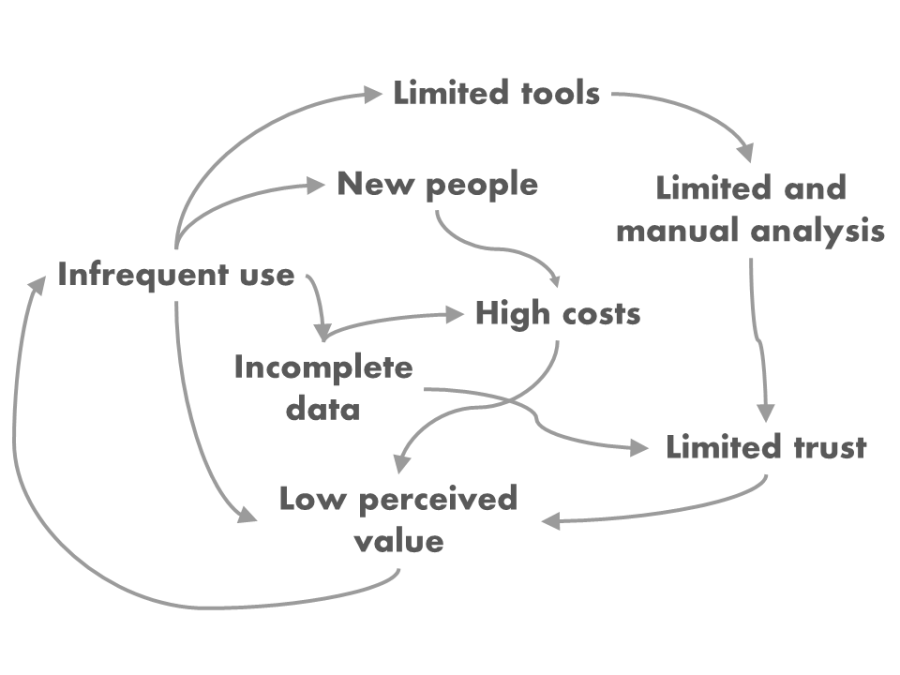

The vicious circle of portfolio management

This portfolio review trap can be read as follows:

- at low maturity levels, portfolio reviews are considered cumbersome and undertaken infrequently;

- because of their low frequency, a large percentage of the people involved are new to the process (maybe external support is hired, maybe internal staff is allocated that has not done this before);

- in addition, because it is infrequent, infrastructure and tooling are not optimized;

- the processes and discipline of continuously maintaining relevant data is low (business cases, project plans, market forecasts etc.);

- al this leads to high organizational costs (lots of effort at peak moments), limited analysis, and limited trust in the results;

- leading to a low perceived value for the decision-making process.

Having going through this cycle once, an organization may have “learnt” that portfolio management done right is expensive, cumbersome, and has limited value… And hence may not be bothered to do this more often.

How to speed up?

From the above feedback loops, it is clear that good tool support can help increase the frequency to a more valuable level. In addition, with proper tool support the learning curve for new people can be reduced, and the corporate memory can better be supported. Also, increasing the frequency (say from annual to quarterly or even to monthly) makes the incremental workload a lot smaller and leaves less room for informal or unmanaged portfolio decisions (crisis interventions).

So what is the right frequency? Let’s look at portfolio management as a decision-making process: a portfolio decision should be revisited when the underlying data and assumptions have changed so much that the decision is no longer grounded. For innovation portfolios, these changes may be internal or external:

- Internal: running projects are deviating from their latest plan and new project candidates flow in from the front-end of innovation;

- external: assumptions about markets, competitors, technology, partner, supply chain etc. need updating

The frequency of revisiting the portfolio should be set so that these changes are signalled and dealt with in time. The actual frequency may differ between more stable and more dynamic environments. We find monthly to quarterly updates match the organizations we work with quite well. Let me know what works best in your domain?

Spot on! Thanks for writing down our struggle so clearly, it sharpens the mind…